IRS 2290 Annual Filing

READ FIRST! If your truck's GVW [gross vehicle weight = truck + trailer + load] is 55,000 pounds or more you need to file the IRS 2290 form annually. This form expires each year on June 30th and is required to submit proof with your apportioned cab card renewal.

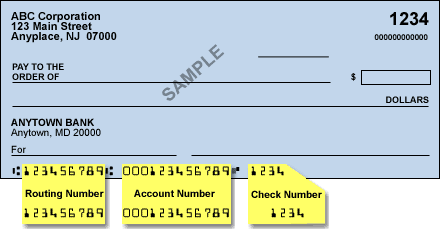

We've made this simple. Complete the form below. Remember these two items...you will be charged a service fee of $39 per vehicle PLUS the tax due. The tax due to the IRS must be paid by a checking account in which you will provide your bank's routing and checking account number. This information is found on the bottom of a check. [see picture below]

Let's say you have 2 trucks @ 80,000 GVW

You will be charged $78 [$39 x 2] + $1100 [$550 x 2 trucks]

Have more than 7 trucks? Simply complete the form again for the additional trucks. Once we process your 2290 taxes with the IRS we will email you a copy of the IRS Stamped Schedule 1 you will need to provide with your state's IRP renewal.

We've made this simple. Complete the form below. Remember these two items...you will be charged a service fee of $39 per vehicle PLUS the tax due. The tax due to the IRS must be paid by a checking account in which you will provide your bank's routing and checking account number. This information is found on the bottom of a check. [see picture below]

Let's say you have 2 trucks @ 80,000 GVW

You will be charged $78 [$39 x 2] + $1100 [$550 x 2 trucks]

Have more than 7 trucks? Simply complete the form again for the additional trucks. Once we process your 2290 taxes with the IRS we will email you a copy of the IRS Stamped Schedule 1 you will need to provide with your state's IRP renewal.