|

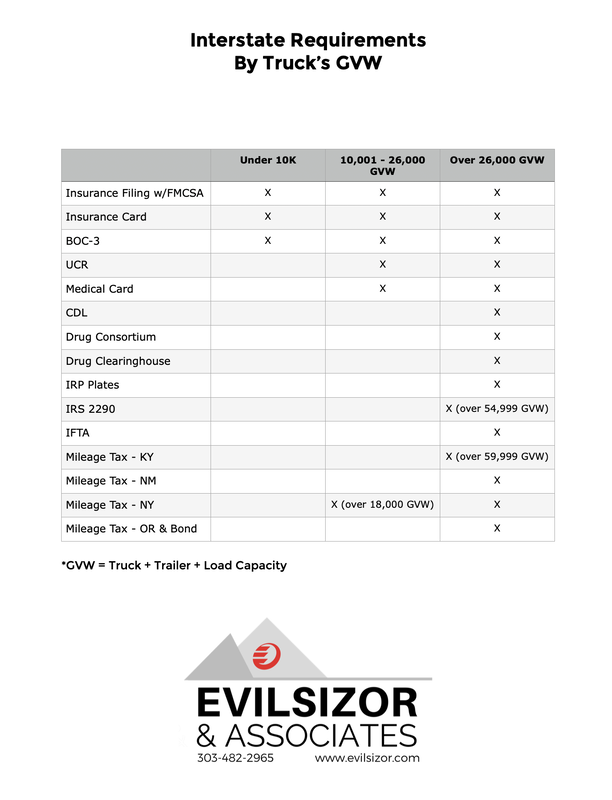

Most of 2021 year is almost over! It's time to think about how to finish 2021 strong and be ready for 2022. I'm not talking about fixing the world's problems. We all know that's a large task and overwhelming. Let's break it down to our world and take care of what we have the most control over. BrokersBrokers have it simple...no really! As far as the FMCSA is concerned just be sure your bond is on file and active along with your BOC-3. The only other thing to worry about is to file your 2022 UCR to remain in total compliance. CarriersMotor carriers have a few more items to take care of. I've broken it down by GVW. Remember, GVW is an acronym for Gross Vehicle Weight. This means you add the weight of the truck, trailer and load. I created a requirement chart by GVW. Take a look at each item and take inventory. Some permits require an annual or biennial filing. Take a look at the chart and compare it with your permit book and take action. There's a few items I want you to focus on before the end of the year. For starters, the current year UCR expires on December 31st. The port officials do not extend any grace period for this permit and will fine you for non-compliance. The fees are determined by your fleet size which is pulled from the safer system. If your fleet size changed be sure you file an MCS-150 first before filing your UCR. We've made this easy if you are seeking assistance in the UCR renewal period. You can request an MCS-150 update along with your UCR renewal. IFTA & mileage tax permits may be renewable. Check with your base state for your IFTA renewal. Some auto renew and some may not. As long as you renew your IFTA by December 31st your existing IFTA decal and license will extend to February 28th of the following year. Be sure your quarterly IFTA tax returns are caught up and have been filed. If you have outstanding returns the state will not renew your permit. Four states have an extra layer of tax for qualifying vehicles to pay a tax per mile traveled. These states are Kentucky, New Mexico, New York and Oregon. Each state has a different qualifying requirement. For example vehicles with a GVW over 59,999 pounds will require a KYU account. Vehicles over 26,000 pounds will need a New Mexico and an Oregon account. Oregon also requires a bond and monthly mileage tax filings. And then there's New York. New York requires all vehicles 18,000 pounds and over to obtain a NY HUT permit and file quarterly taxes. Take a look at your permits and see if there's an expiration date listed. If you're unsure if they expire I would recommend you contact the state directly. IRS 2290 expires every year on June 30th. There is a 2 month grace period. After that the IRS will implement a penalty for non-payment or late-payment. The 2290 fees are based upon the GVW of the vehicle. IRP renewals vary from state to state. Check your cab card's expiration date as a point of reference. Bottom line, it's time to take a few moments to look at your permit book and make sure it's complete. Not taking a few moments may result poorly in possible shutdowns and/or expensive fines.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Penni RoystonHi! I've been working in this industry for over 34 years. I've learned a lot and want to share it with you to help you keep this process simple! Archives

March 2024

Categories

All

|

ServicesFile a BOC-3

Online Courses |

Company |

|

RSS Feed

RSS Feed